Collectibles are a multi‑billion market with no way to hedge or short, leaving holders fully exposed to crashes.

Markets are illiquid and slow, making price discovery poor and professional capital unwilling to participate.

Retail wants exposure without custody, and traders want directional and hedging tools, but there is no scalable instrument today.

Need full capital upfront to speculate; can't get leveraged exposure to assets you believe in.

Longsword is a decentralized, orderbook exchange purpose-built for collectibles perpetuals, combining an off-chain Central Limit Orderbook with verifiable on-chain settlement to deliver continuous price discovery, instant liquidity, and capital efficiency for illiquid assets.

Experience institutional-grade perpetuals with the transparency and security of decentralized infrastructure.

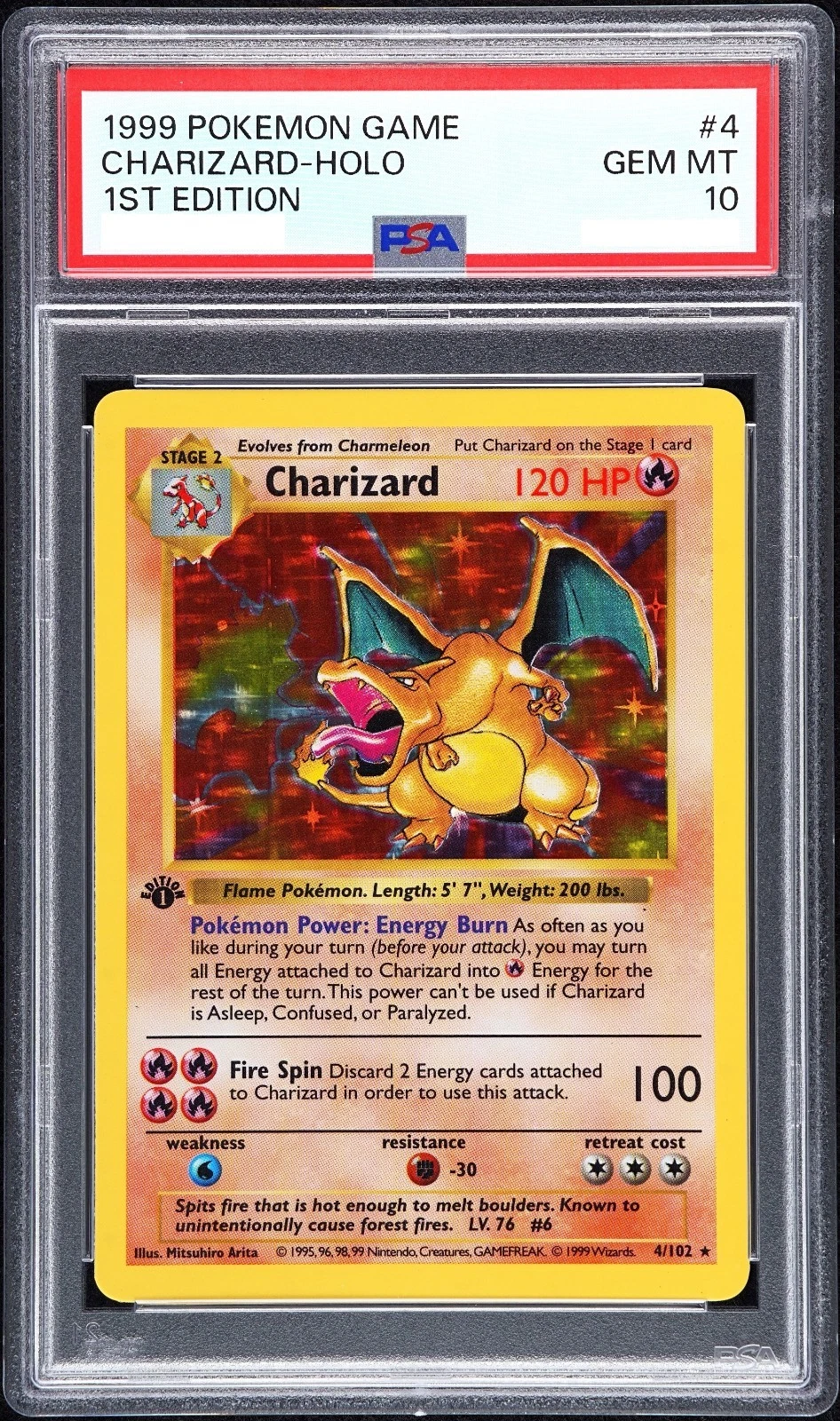

Trading cards ($25B), watches ($75B), art ($65B+) and other collectibles represent massive capital with no hedging

StockX does $2B+ annually in sneakers and cards; Chrono24 processes $3B+ in watch sales; Heritage Auctions moved $1.3B in collectibles in

StockX, eBay, PWCC, and other platforms handle billions in secondary market volume. Traders want price action, not cardboard. Perps give them what they actually need: leverage and exits.

Longsword lets users leverage their collectibles while hedging risk without having to sell them.

Users secure their positions by depositing tokenized collectibles from platforms like Courtyard

Get up to 10× exposure on your collectible's value without selling your prized assets

Open short positions to protect against market downturns while maintaining ownership

Leveraging innovative architecture inspired by rollup technologies to achieve unparalleled scalability and efficiency.

Orders are compressed into Merkle roots anchored on-chain, preserving cryptographic integrity while minimizing state growth.

Trades are aggregated and settled in batches, dramatically lowering costs while enabling fast, continuous execution.

Complete transaction data lives off-chain on dedicated availability layers, remaining fully accessible and independently verifiable.

Permissionless deposits and withdrawals ensure user control and transparency.

Specialized vaults manage specific functions like positions and liquidations, minimizing systemic risk.

Provides an additional layer of security for dormant assets.

Each vault has a single, focused purpose, enhancing overall system robustness and auditability.

Institutional-grade speed competitive with centralized exchanges

Zero fees for liquidity providers to incentivize users to provide liquidity

Continuous price discovery with no expiry or settlement gaps

Drag to feel the power

Be among the first to trade perpetuals on collectibles. Get exclusive access to our testnet launch.